Our Approch

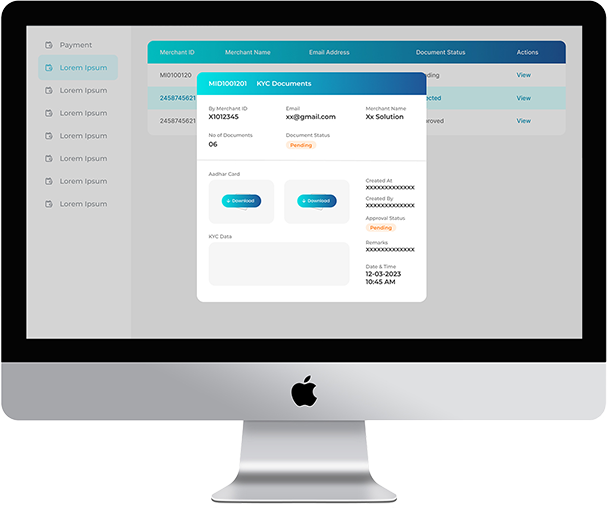

At Amogapay, our approach centers on speed, security, and seamless integration. We work hand-in-hand with merchants, developers, and enterprises to simplify digital transactions across platforms. Every solution is designed to ensure frictionless user experiences while maintaining the highest security standards. From onboarding to real-time analytics, we provide full-stack support that empowers businesses to scale with confidence. We don’t just process payments—we power growth through intelligent transaction design.

-

Client

Amogapay

-

Industry

FinTech

-

Services

Online Payment Processing

Deliver Only Exceptional Quality, And Improve!

-

Brainstorming We start by understanding client goals, market needs, and user expectations to define a clear payment solution vision. Concept Prototype Our team rapidly builds interactive prototypes to visualize key features and flows, refining functionality with stakeholder input. Design Layout User experience takes priority—our intuitive interface designs ensure secure, simple, and responsive transaction journeys. Design Layout We test rigorously across use cases to ensure speed, compliance, and security, making refinements before full-scale launch.

Tech Stack

Our technology stack combines modern, reliable, and scalable tools to ensure smooth development and optimal performance. From frontend frameworks like HTML5, CSS3, and Bootstrap to backend support with Java and jQuery. This balanced tech approach allows us to build fast, flexible, and future-ready platforms.

Branding

Color Palette

Results

At Amogapay, our solutions have helped businesses streamline their digital payment processes, reduce transaction times, and enhance customer trust. By delivering secure, scalable, and high-performance gateways, we’ve enabled clients to grow revenue and simplify operations. Our data-driven approach ensures every payment counts—efficiently and compliantly. Whether it’s expanding globally or integrating new payment methods, we help clients stay ahead. The result? Smarter, faster, and more reliable digital transactions.

- Improved payment success rates

- Faster transaction processing

- Enhanced platform security

- Seamless global payment support

- Increased customer satisfaction

top